By way of example, the IRS notes that these an entity can drop its tax-exempt standing by actively having steps to generate personal money or via political lobbying behaviors.

Sole proprietorship: A sole proprietorship is easily the most essential kind of business. In reality, you automatically have a single in case you don’t register as another business variety. Such a business enjoys the move-via taxation of an LLC, but with no security from private liability.

Alongside understanding how to start an LLC, Here are a few crucial specifics to manage that lead for the results of The brand new entity or which may serve as additional necessities for running your business.

Each LLCs and partnerships are allowed to go through their profits, along with the obligation for paying out the taxes on them, to their owners. Their losses can be employed to offset other cash flow but only as many as the amount invested by a member.

to agree without offering consent to generally be contacted by automated signifies, textual content and/or prerecorded messages. Prices may perhaps use.

Some states, for instance Nebraska and Big apple, demand you to publish a discover within the newspaper indicating your desire to register your LLC. This move have to be concluded just before filing the article content of Business.

An LLC can have one operator (generally known as a “member”) or numerous customers. Businesses and also people can be users of an LLC.

LLC vs. Partnership The first difference between a partnership and an LLC is an LLC separates the business belongings in the company from the personal assets with the homeowners, insulating the owners from the LLC's debts and liabilities.

Both corporations and LLCs supply their homeowners with limited liability. But LLCs are ordinarily taxed like sole proprietorships or partnerships. Moreover, LLC entrepreneurs tend not to perform as employees on the LLC—They are really self-utilized business entrepreneurs.

One-member and multimember LLCs may also elect to file taxes as a company, which can lessen the amount your LLC owes. LLCs that file as businesses acquire use of tax breaks and publish-offs other structures are not able to use.

Editorial Take note: We earn a commission from husband or wife hyperlinks on Forbes Advisor. Commissions don't impact our editors' website views or evaluations. Getty An LLC, or limited liability company, offers business operators the protections normally only afforded to companies as well as the simplicity generally only available to sole proprietorships.

Often, you have to also give a certification of good standing and additional documentation try here to very clear how for registering your business in other states.

While the cost to register an LLC varies by point out, There exists a fee to register in each and every state. So, though there are a few organizations that promote “totally free” LLC formation, what this means would be more info that the company will fill out the LLC paperwork for you totally free. But once again, you'll still be accountable for the point out’s filing charge.

One of The key early conclusions business owners should make is what business entity to register under. There are lots of business entity forms from which to choose—a sole proprietorship, C Company, S corporation, limited liability company (LLC), or limited liability partnership (LLP). What business structure you select on relies on the chance you are willing to assume.

Shaun Weiss Then & Now!

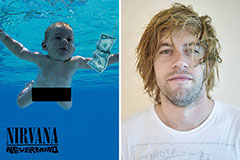

Shaun Weiss Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!